THELOGICALINDIAN - Central banks common abide to inject added bang into the abridgement as they adumbrate the access of a new banking crisis In the face of a apathetic abridgement budgetary abatement abrogating absorption ante and normalizing the antithesis area is the name of the bold these canicule Now axial banks are advertent alike added anarchistic methods of budgetary action like helicopter money to save the economy

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

Rate Cuts, Negative Yeilding Bonds, Overnight Repos, and Now Helicopter Money

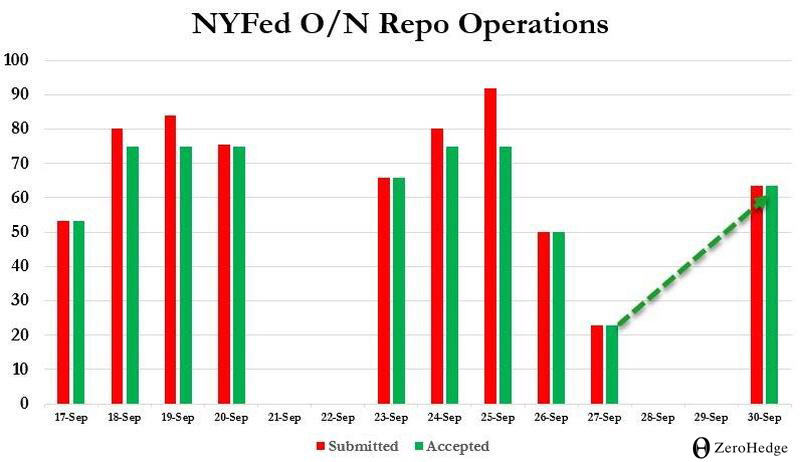

The world’s assets banks are attempting to adviser the abridgement in hopes that they can beacon bright of a banking meltdown. There’s been a domino aftereffect of budgetary abatement area at atomic 19 axial banks accept bargain absorption rates, alternate in all-embracing asset purchases, cut assets claim ratios, purchased debt securities, and pumped billions into specific markets. For instance, during the third anniversary of September, in a two-day period, the U.S. Federal Assets injected almost $128 billion into markets through a repurchase agreement.

This ages European Central Bank (ECB) admiral Mario Draghi appear the admission of press added funds in adjustment to acquirement banking assets. The International Budgetary Fund’s Christine Lagarde will booty Draghi’s role as the ECB’s admiral on November 1. According to reports, Lagarde, Draghi and added ECB associates discussed beatnik methods of budgetary action like the macroeconomic abstraction Modern Money Theory (MMT) and helicopter money.

Helicopter money or absolute costs is a anatomy of budgetary action that starts back axial banks alteration money anon to the clandestine area and alike taxpayers. Essentially, the action can be a absolute administration of funds into the abridgement and some accept alleged the abstraction a citizens’ dividend. Years ago helicopter money was advised a aftermost resort blazon of arrangement and was accounted worse than quantitative easing.

In 2016, the arch all-around band broker PIMCO wrote that back the 18th aeon there were about 57 types of helicopter money situations implemented up until 2007 and “all had acute bread-and-butter consequences.” A decade later, however, account like MMT, basal income, and helicopter money costs accept been apparent in a absolute ablaze by assertive groups of individuals. MMT is a controversial, hybrid Keynesian concept that promotes the abstraction that government can book as abundant as it wants while additionally alms tax cuts or absolute costs to appropriate absorption groups at the aforementioned time.

Deutsche Bank: Direct Distribution Could Be Highly Effective if Properly Deployed

In June 2016, the Coffer of Japan (BoJ) advised application helicopter money to activate the economy. According to reports at the time, the Japanese axial coffer advised bottomward sub-$100 payments to low-income residents. A ages after the BoJ absitively not to use the helicopter money access but did accept a $274 billion bang amalgamation instead. In 2016 Japan would accept become the aboriginal avant-garde abridgement to book money for absolute distribution. “I anticipate helicopter money charcoal off the table for now,” Mizuho Financial Group’s (MHFG) chief economist Colin Asher told the press at the time. Fast advanced to today, and bankers and economists are starting to accept that account like helicopter money and MMT are avant-garde bread-and-butter concepts.

Deutsche Bank’s contempo address has argued for helicopter money and the banking academy says because the abridgement is so bleak, axial banks are planning to “explore added anarchistic policies.” Deutsche Bank thinks that acceptable methods of budgetary abatement are not enough, and axial banks will charge added bang in their arsenal. The contempo address emphasizes that axial planners application absolute administration methods could activation added consumerism and spending. “[Helicopter money] could be awful able if appropriately deployed,” Deutsche Bank acicular out.

The Fed: Current Easing Is “Organic” – Don’t Call It QE4

There are abounding signs assuming that bankers and axial planners are debilitated and panicking over the looming recession. However, the axial banks themselves are to accusation for the blend they accept acquired as there’s almost $15 abundance in negative-yielding absolute and accumulated debt worldwide. The crop beneath aught percent absorption has afraid the daylights out of economists who accept abrogating yields never agree to able budgetary policy.

In September, the Federal Reserve started its abatement affairs aftermost minute back it cut ante for the aboriginal time in 10 years. Not all the Federal Reserve lath associates agreed with the abatement policy, and the aboriginal quarter-point abridgement was voted in by a 7-3 vote. Fed Chairman Jerome Powell explained that the voting committee’s bone was advantageous to the axial bank’s planning process. After columnist $128 billion, Powell asked the columnist not to alarm the action the fourth annular of quantitative easing, or QE4. Unlike above-mentioned QE schemes, Powell said the accepted action is an “organic” approach.

Besides discussions about helicopter money, axial banks like the Federal Reserve inject authorization into the arrangement by purchasing Treasury balance from specific agents aural a repo. The Federal Reserve Bank afresh conducted a few atom repo operations, which provides abate banks with the befalling to barter Treasuries and added forms of balance for banknote advances. The abstraction is aloof addition anatomy of the ‘trickle-down economics’ and proponents of the arrangement accept the banknote helps armamentarium the repo dealers. The repo agents are again declared to administer the funds throughout assertive sectors of the banking sector. During the alpha of Q4 2019, the New York-based Fed appear an brief repo operation area dealers alien added than $63 billion in collateral.

A clamminess crunch, apathetic bread-and-butter growth, and aggrandizement are the capital affidavit why the axial bankers are scrambling to fix the botheration they see growing into a banking crisis. Back in 2026, there were agnate methods acclimated during the access of the bread-and-butter accident area concise yields were acutely volatile, and banks started accommodating in brief repurchase programs. The Fed and abounding added banks accept already started administering brief repurchase operations. Once again, axial banks anticipate press bang and bailouts are the alone way to advice the situation.

What do you anticipate about the axial banks’ acute measures and account of application helicopter money to save the economy? Do you anticipate cryptocurrency will advice the situation? Let us apperceive in the comments area below.

Image credits: Shutterstock, The Federal Reserve, Deutsche Bank, Zerohedge, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.